看法动态

Reuters:China's Hony Capital will continue to invest in U.S. regardless of Trump's China stance

AddTime:2017-02-23

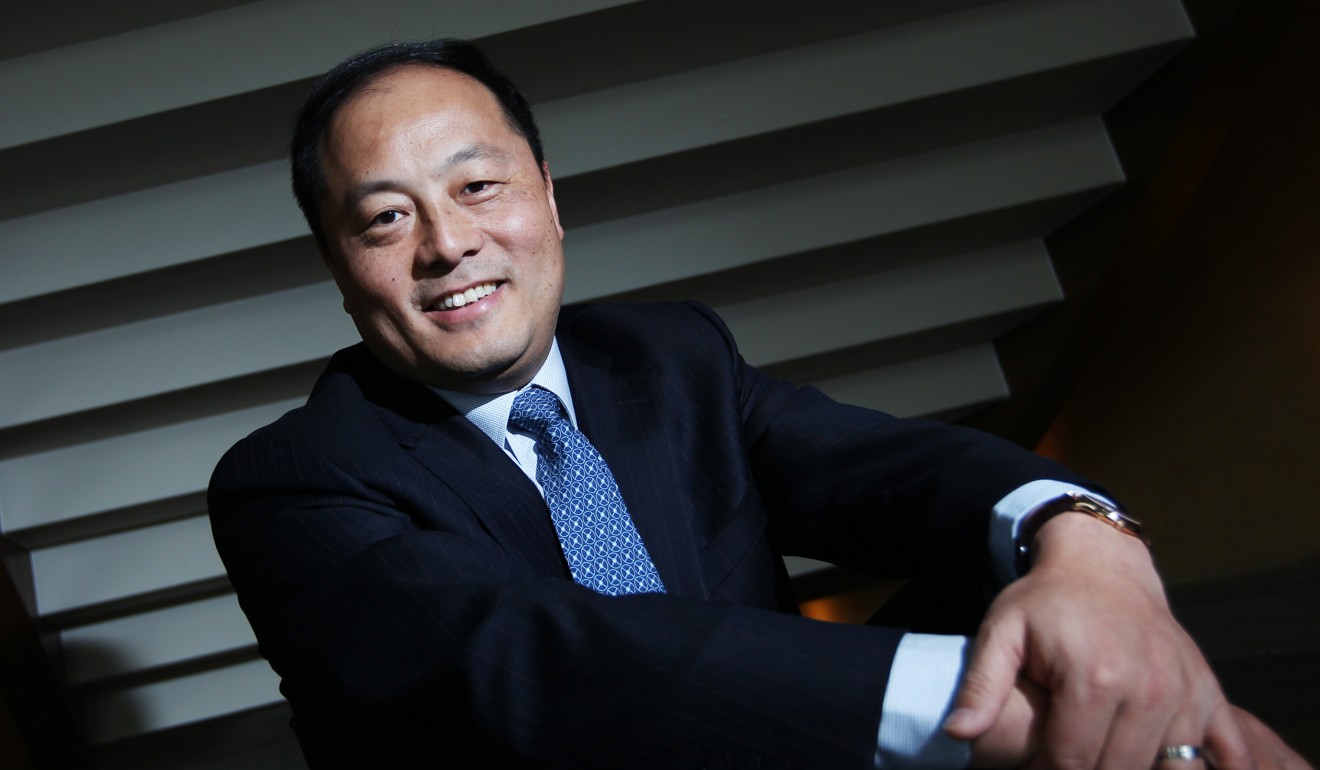

Hony Capital, one of China’s largest private equity funds, will continue to invest in the United States regardless of any aggressive rhetoric toward China from new U.S. President Donald Trump, its founder and chief executive officer said on Thursday. The private equity firm, which is backed by Legend Holdings Corp (3396.HK), parent of personal computer maker Lenovo Group Ltd (0992.HK), will continue to scour the U.S. for investment targets in the consumer, services and healthcare sectors, John Zhao said at a press briefing in Hong Kong.

“There were some concerns when Trump just started his presidency but now things have become clear: no matter who is the American president, that person, including Trump, will have to take the Sino-U.S. relationship very seriously.”

Chinese investors have come under greater regulatory scrutiny in the United States during the past year, and the new Trump administration has spoken of retaliating to Chinese trade practices that it deems protectionist.

Zhao said such developments were not a concern for Beijing-based Hony, which manages about $10 billion worth of assets and which has invested $300 million in the U.S. since 2014, including in Hollywood film studio STX Entertainment and office space provider WeWork.

“Our attitude is not wait-and-see. We will certainly continue to look for assets and make investments in the U.S.”

Hony, Legend and property developer China Oceanwide Holdings Ltd (0715.HK), among others, invested $700 million in WeWork last year. The deal valued WeWork at $16.7 billion, according to Hony, making it among the world’s most valuable startups.

WeWork provides shared office space for users such as entrepreneurs and freelancers in the Americas and Europe as well as in Hong Kong and Shanghai. It plans to open a Beijing space in May, WeWork co-founder Miguel McKelvey said at the same briefing.

WeWork will continue to raise capital to finance expansion ahead of an expected public listing, McKelvey said, without indicating a time frame.