看法动态

Dow Jones: Hony Capital: To Focus On Consumption-Oriented Industries

AddTime:2010-01-29

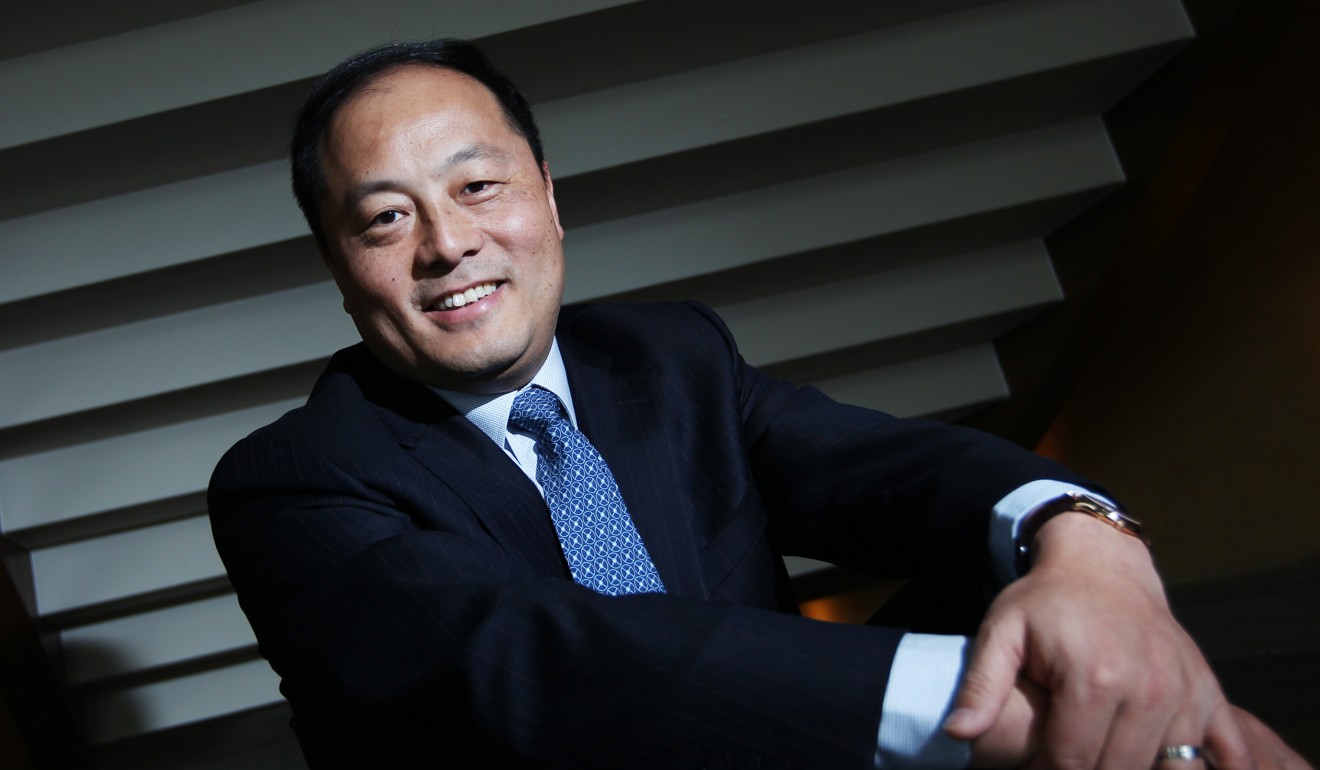

DAVOS, Switzerland (Dow Jones)--Chinese private-equity firm Hony Capital Ltd. will focus its investment this year on industries that will benefit from the country’s economic structural shift toward domestic consumption, the company’s Chief Executive John Zhao said Friday.

"The Chinese economy’s long-term upward trajectory and its growing reliance on consumption instead of exports will bring a lot of opportunities for private equity," Zhao told Dow Jones Newswires in an interview on the sidelines of the World Economic Forum here.

"We continue to be interested in sectors such as construction-related material, pharmaceutical firms, homegrown luxury products as well as media," Zhao said.

A leading private-equity firm in China, Hony has over CNY20 billion worth of assets under management, which are spread across 28 local companies. The Beijing-based company now runs five funds, including four U.S. dollar-denominated funds and a yuan-denominated one.

Hony’s bullishness toward construction-related manufacturers stems from China’s long-term policy of quickly urbanizing its vast rural population, Zhao said. "This will generate a lot of demand for that industry."

In addition, as Chinese people’s disposable income rises steadily, they will spend more money on healthcare and crave more luxury brands, he added.

Commenting on China’s trial project to let some foreign private-equity firms to set up yuan-denominated funds, Zhao said the move won’t pose any serious threat to local players such as Hony.

"Private equity is still a young industry in China and the pie is big enough for everyone. This will be the case for a long time," he said.

Zhao added that Hony will remain focused on the domestic market and won’t directly invest in overseas assets.

"This will continue to be our strategy for now because China has way more opportunities and the return is always much higher," he said.