看法动态

South China Morning Post : He's got US$ 4b and he's ready to spend

AddTime:2012-01-07

Hony Capital, the private equity arm of Legend, plans to take more than 10 companies public this year after raising US$4.1 billion to become the largest domestic private equity fund in the country.

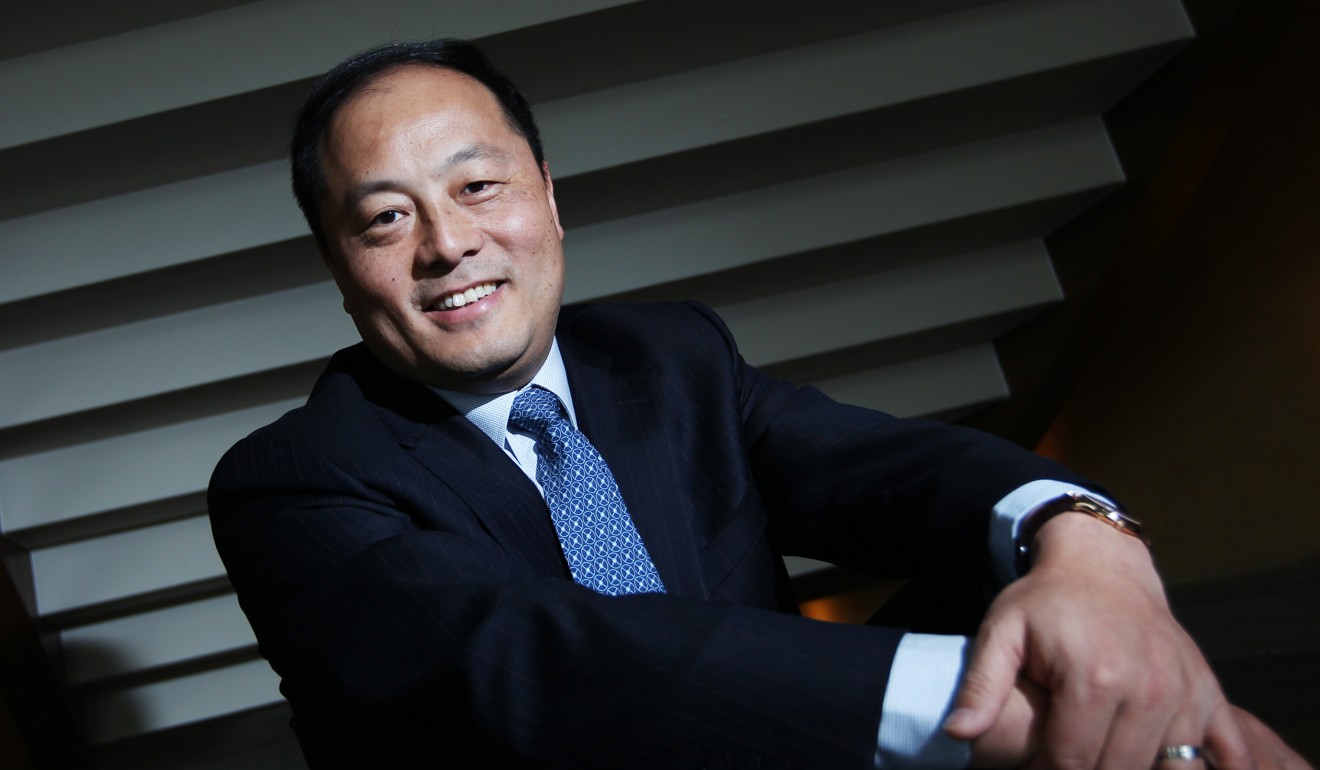

John Zhao Linghuan, the founder and chief executive of Hony, said the fund preferred to list most of the companies in Shanghai and Hong Kong, although Nasdaq remained an option for high-technology firms.

Market enthusiasm for mainland companies deteriorated last year after scandals with some smaller Chinese firms shook Wall Street's confidence in China's businesses.

Problems do exist with some Chinese firms, Zhao said, although there were also genuinely good ones seeking improvement in management and guidance when going overseas. That was where Hony came in.

Hony preferred long-term investments of three to five years, Zhao said. The company has invested in more than 70 firms since its establishment in 2003 and still owns stakes in more than 60 of them.

When we choose partners, we never just provide money, he said. If a company only wants money, we say, `good luck', and walk away. We always ask, `What is your dream, what do you lack in realising that dream,' and then we check if we have the ability to fill that gap.

Adding value, Zhao said, was where Hony's importance laid. The fund takes pride in the fact that, in the past, it successfully helped several state-owned enterprises restructure, including the Changsha-based Zoomlion Heavy Industry Science and Technology, one of the largest construction machinery manufacturers in China.

We don't ask companies to list for the sake of listing, he said. If a company fails to deliver good quarterly performances after listing, it is detrimental to the firm.

In the future, the fund would invest about half of its money in state enterprises, with the rest in medium to large-sized private firms, Zhao said.

This year, because there are economic uncertainties at home and abroad, Zhao said the company's top picks included sectors such as infrastructure, consumer products, green energy and technology.

Last month's fund raising marked the fifth time Hony raised money for its US dollar fund. It attracted US$2.37 billion. It was also the second time it raised money for its yuan fund, which attracted 10 billion yuan (HK$12.2 billion).

Most of the investors came from Legend, US pension funds, Middle Eastern sovereign funds and China's National Social Security Fund. There are roughly 3,500 private equity funds in China, a majority being domestic, according to David Brown of PricewaterhouseCoopers.