看法动态

CNBC: Hony Capital CEO on China’s capital controls

AddTime:2017-03-20

Hony Capital, a?Chinese?private equity firm that says it has about $10 billion under management, is in a potentially tight spot as Beijing implements capital controls and anti-globalist rhetoric grows more popular throughout the world.

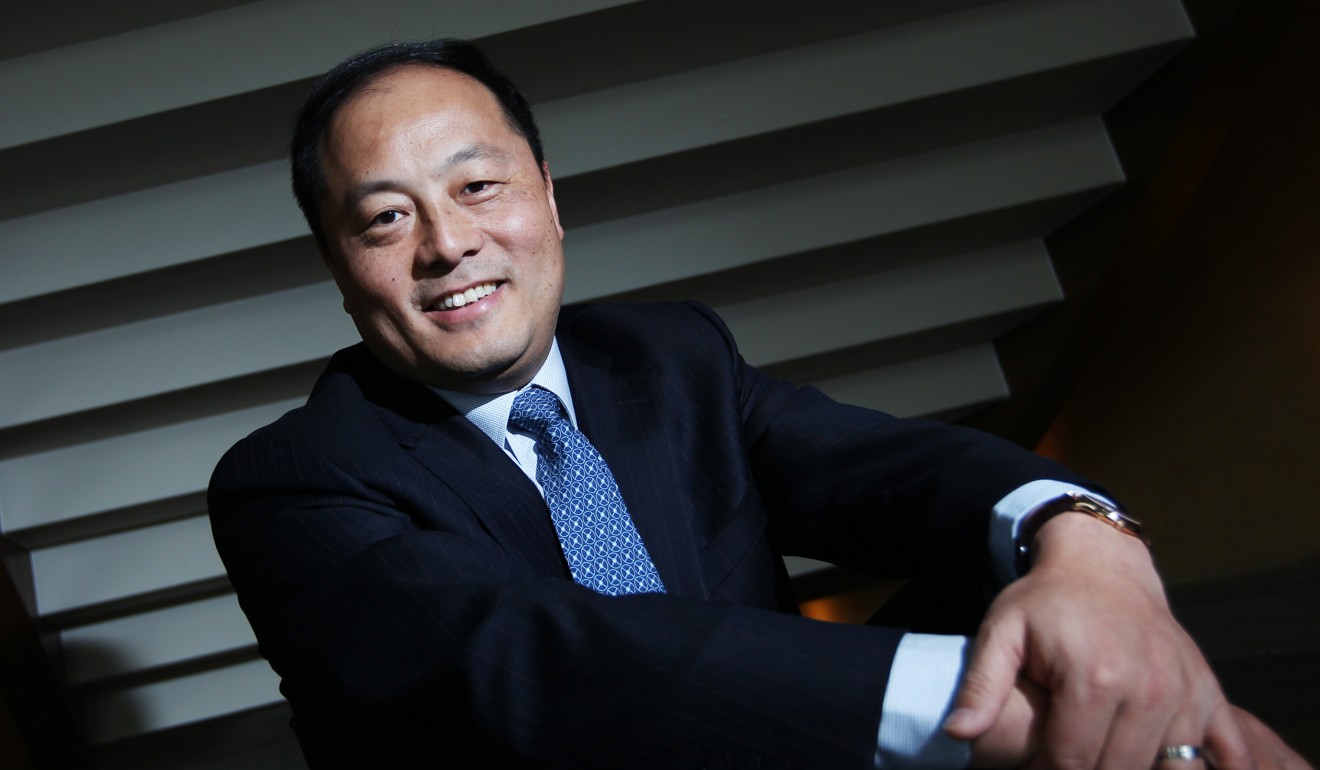

But John Zhao, Hony Capital’s CEO, struck a positive note in a Saturday interview with CNBC at the China Development Forum, pointing to the guidance of China’s leadership.

“If you listen to President Xi [Jinping], he made a remarkable speech at Davos and he is advocating globalization, addressing some of the problems past globalizations had cost,” he said. “And if you listen to that blueprint, it’s all about more trade, more globalization.”

Yet Beijing itself has clamped down on capital outflow, and Zhao offered a frank assessment of that situation.

“Immediately it has some setbacks: When the money doesn’t flow, the deal stops,” he said. “I think a lot of these adjustments are really meant for better development. But then, as a tactician you need to be aware of that, so the money flow restriction has had an impact to the deals and things have slowed down, and we’ll just see what happens.”

Still, Zhao said he thinks the controls are only a temporary measure: “In the long run, as I said, you know everybody has benefited from previous globalizations and we just need to figure out what’s the better version of it.”

But that doesn’t mean the free flow of business is a given going forward, he said, acknowledging that he takes the threat of a trade war between China and the U.S. “very seriously.” Still, Zhao deemed himself an optimist.

“My view is that China and the U.S. relationship will not sour because there is too much interdependence building already,” he said.

“There are issues: The two countries represent a different political system, different history, heritage, people in terms of culture are also very different,” Zhao added. “But we’ve been very successful ... working out the differences and finding common ground. Why not this time?”