看法动态

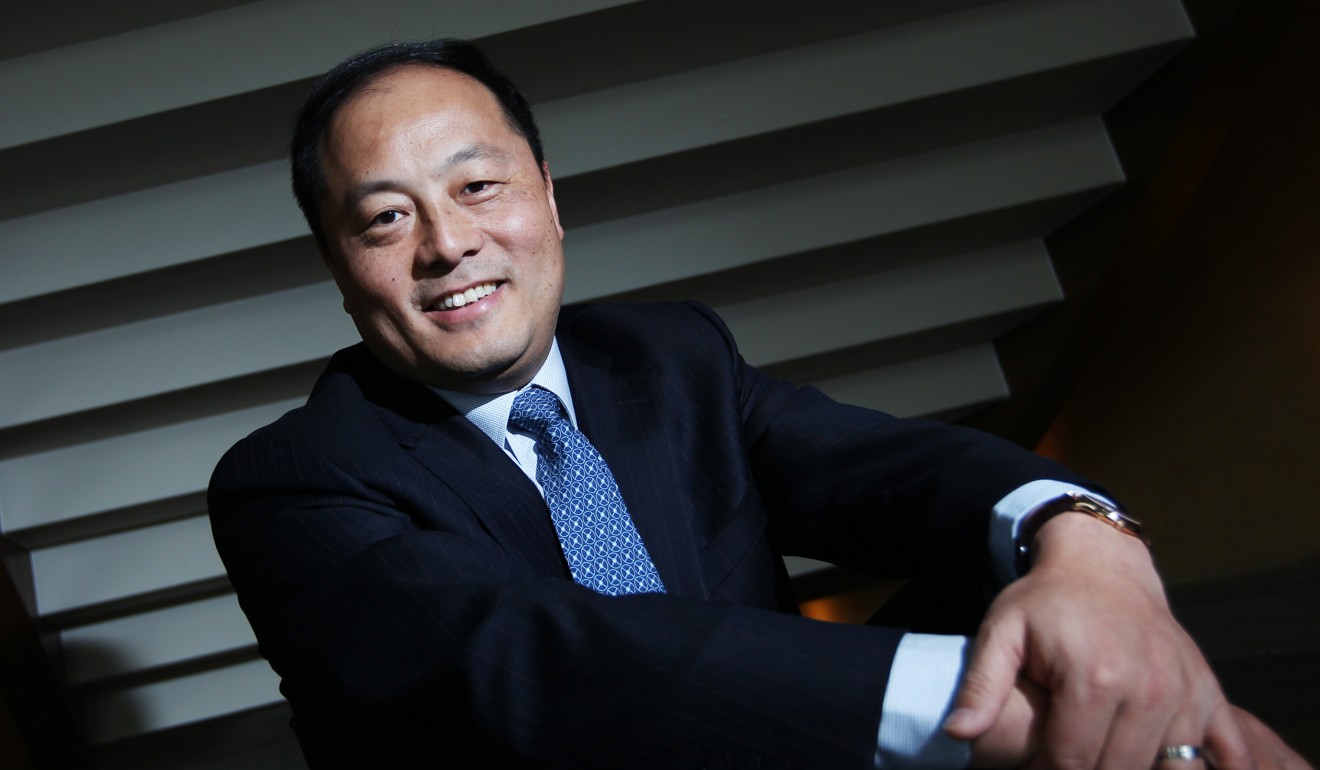

Reuters: John Zhao seeks more targets in state sector reform

AddTime:2014-04-14

Hony Capital, the private-equity firm backed by Legend Holdings, is likely to deploy more capital in China's state-owned manufacturing and?healthcare?sectors as?Beijing?seeks to further restructure its government-owned companies.

"This is a fabulous opportunity," said John Zhao, Hony Capital's founder and chief executive, in a recent interview. "We've accumulated a lot of strengths, experience and scars."

Hony, one of China's biggest private-equity firms, has taken stakes in 31 state-owned firms, investing 14 billion yuan ($2.25 billion) over the past decade. The total value of those companies has more than doubled on average, the company says.

The Beijing-based investor has led restructuring of China Yaohua Glass Group, one of China's biggest sheet glass manufacturers, construction equipment giant Zoomlion Heavy Industry Science & Technology Co and Lianyungang Zhongfu Lianzhong Composites Group, a manufacturer of heavy-duty pipe, rotor blades for wind turbines, and industrial tanks.

In January, China's securities regulators approved Hony's bid to take a 10 percent stake in Shanghai Chengtou Holding Co, a city-backed real-estate and waste-management company, for 1.8 billion yuan.

China has promised sweeping changes to its state industry. Last month, the National People's Congress, the country's mostly rubber-stamp parliament, said it would "encourage non-public business" to invest in state businesses. That is creating new openings for private-equity funds, both foreign and domestic.

"We will see good firms separated from bad firms," Zhao said.

Sinopec, Asia's biggest oil refiner, said in February it was selling up to 30 percent of its marketing arm, in a multi-billion-dollar deal involving more than 30,000 petrol stations that is expected to close later this year.

"There's a consensus (among state company managers, government regulators and investors) that market-driven is much better than state control for competitive industries," Zhao said.

Film and entertainment

Hony raised its first $38 million fund from state-sponsored investment holding company Legend Holdings Corp in 2003 and today has about $7 billion under management, including $2 billion in cash.

It has invested in industries ranging from heavy equipment to renewable energy, and lately has started to take a sizable position in China's hot film and entertainment sector.

Last month, Hony announced it was teaming-up with producers Robert Simonds and Gigi Pritzker plus TPG Capital to invest more than $1 billion over five years in a film studio that will produce and self-distribute as many as 10 theatrical films a year.

Last year, Hony also helped capitalize a 3 billion yuan fund with Shanghai Media Group's SMG Pictures to invest in television and film, primarily animation.

Hony Capital also is moving to complete its buy-out of New York-listed mobile games developer Giant Interactive Group, Zhao said.

In March Hony, Baring Private Equity Asia and Giant chairman Shi Yuzhu said they would acquire the 50.7 percent outstanding shares in the Cayman Islands-registered firm they did not own.

"We'll re-list that," said Zhao, declining to discuss markets or timelines. "We're still in the middle of trying to privatize it. It's a sizable business."

Forced creativity

Zhao, who has divested stakes in 15 companies, says that private-equity managers are finding increasingly creative ways to exit investments, as the shutdown of China's capital markets for more than a year and the difficult financing environment have taken their toll.

Initial public offerings, which represented more than 90 percent of private equity exits in 2011, decreased to less than one-fifth by 2013, according to Hony data.

"All this creativity is being forced out of us," Zhao said. "In China, we are seeing IPOs, mergers, management buyouts and buybacks. This is a good sign. There's a lot of work that a value-creation minded private equity firm can engage in."